Latest Mobile Payment Innovations and Their Impact on US Consumers

The latest innovations in mobile payment technologies, such as contactless payments, blockchain, and biometric authentication, are transforming the consumer experience in the US by offering greater convenience, security, and speed, but also raising concerns about data privacy and accessibility.

Are you curious about how your phone is changing the way Americans pay for everything? The rise of digital wallets and contactless payments is reshaping the financial landscape. Let’s explore

the latest innovations in mobile payment technologies and their impact on US consumers.

What’s New in Mobile Payment Technologies?

Mobile payment technologies are constantly evolving, driven by consumer demand for convenience and security. These innovations are not just about making payments faster; they are fundamentally changing how we interact with money and businesses.

Contactless Payments

Contactless payments, using technologies like NFC (Near Field Communication), have become increasingly popular. They allow users to simply tap their phones or cards against a payment terminal for quick transactions.

Blockchain Technology

Blockchain technology is starting to make its way into the mobile payments space, offering enhanced security and transparency. Cryptocurrencies and blockchain-based payment systems provide alternatives to traditional banking.

Here are a few noteworthy applications:

- Cryptocurrency Payments: Paying with Bitcoin or Ethereum via mobile wallets.

- Decentralized Finance (DeFi): Using mobile apps to access DeFi services, such as lending and borrowing.

- Secure Transactions: Leveraging blockchain for secure and transparent transaction records.

These technologies not only offer enhanced security but also reduce transaction costs by cutting out intermediaries.

The Rise of Digital Wallets

Digital wallets have streamlined the payment process for online and in-store purchases. These virtual wallets can store multiple credit cards, debit cards, and loyalty cards, making payments easier and more organized.

Digital wallets are changing the way we conduct transactions, offering a versatile, secure, and convenient alternative to traditional payment methods, and are having an impact on consumer behavior across generations:

- Apple Pay: Seamless transactions on Apple devices.

- Google Pay: Android-based mobile payment system.

- Samsung Pay: Mobile wallet with MST (Magnetic Secure Transmission) technology.

The convenience of having all your payment methods in one place has significantly contributed to the increased adoption of mobile payments.

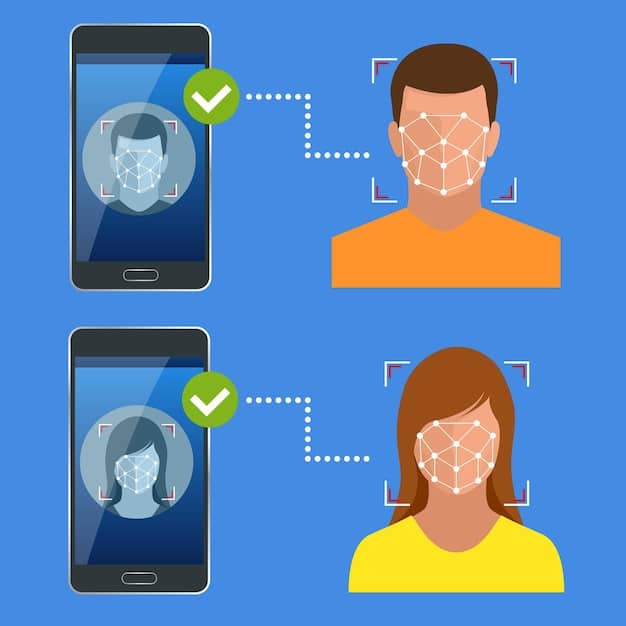

Biometric Authentication for Enhanced Security

Security is a major concern in the mobile payments space. As a result, biometric authentication methods like fingerprint scanning and facial recognition are becoming standard features in mobile payment apps. They enhance the security layer by ensuring that only authorized users can make transactions.

Biometric payment methods, such as fingerprint and facial scans, are adding higher degrees of trust and safety to mobile transactions:

Fingerprint Scanning

Many smartphones now come equipped with fingerprint scanners, making it easy to authenticate payments with a touch. This method is considered more secure than traditional passwords or PINs.

Facial Recognition

Facial recognition technology offers another layer of security. Users can authenticate payments simply by looking at their phone, making the process seamless and secure.

These biometric methods significantly reduce the risk of fraud and unauthorized access, fostering greater confidence in mobile payment systems.

Impact on US Consumers: Convenience vs. Concerns

Mobile payment technologies offer numerous benefits, but they also raise concerns among US consumers. Understanding these impacts is crucial for businesses and consumers alike.

The evolution of mobile payment platforms have resulted in greater convenience for American consumers, but not without some drawbacks. Let’s weigh the pros and cons of these innovative paradigms:

Increased Convenience

Mobile payments offer unparalleled convenience. Consumers can make purchases quickly and easily, whether they are shopping online or in a brick-and-mortar store. The ability to pay with a simple tap or scan has streamlined the shopping experience.

Security Risks and Data Privacy

Despite security enhancements, mobile payments are not without risks. Data breaches and hacking remain significant concerns. Consumers worry about the security of their personal and financial information, emphasizing the need for robust security measures.

Overall, mobile payment technologies have brought significant convenience to US consumers, but they also highlight the need for enhanced security and data privacy measures.

Mobile Payments and Financial Inclusion

Mobile payments are also playing a role in promoting financial inclusion, particularly for underserved populations. They provide access to financial services for individuals who may not have traditional bank accounts.

Mobile money platforms are also expanding access to financial structures for millions of unbanked individuals in the United States:

- Access to Banking: Mobile wallets serve as a viable alternative to traditional bank accounts.

- Remittance Services: Facilitating easier and cheaper money transfers.

- Microfinance: Enabling small loans and financial services through mobile platforms.

By leveraging mobile technology, these platforms bring financial services to those who need them most, fostering financial empowerment and economic growth.

Future Trends in Mobile Payments

The future of mobile payments is likely to be shaped by several emerging trends, including further integration of AI, the rise of central bank digital currencies (CBDCs), and enhanced personalization.

Advancements in artificial intelligence, blockchain technology, and governmental monetary policy are poised to redefine how consumers interact with financial institutions:

Artificial Intelligence (AI) Integration

AI is expected to play a greater role in mobile payments, particularly in fraud detection and personalization. AI algorithms can analyze transaction data to identify suspicious activity and provide personalized recommendations to users.

Central Bank Digital Currencies (CBDCs)

Some countries are exploring the possibility of issuing central bank digital currencies. These digital currencies could be integrated into mobile payment systems, offering a secure and efficient way to transact.

Enhanced Personalization

Mobile payment apps can use data analytics to provide personalized experiences, such as customized rewards and offers. This level of personalization can enhance user engagement and loyalty.

These trends promise to make mobile payments even more seamless, secure, and personalized in the years to come.

| Key Point | Brief Description |

|---|---|

| 📱 Contactless Payments | Quick transactions via NFC technology. |

| 🔒 Biometric Authentication | Enhanced security using fingerprint scanning and facial recognition. |

| 💰 Digital Wallets | Store multiple cards for organized and easy payments. |

| 🌐 Blockchain Integration | Offers secure and transparent payment options. |

[Frequently Asked Questions]

▼

The main types include NFC for contactless payments, mobile wallets like Apple Pay and Google Pay, QR code payments, and blockchain-based payment systems. Each offers a different approach to facilitate digital transactions.

▼

Biometric methods, such as fingerprint scanning and facial recognition, ensure that only authorized users can make transactions. This reduces the risk of fraud and unauthorized access to payment systems.

▼

Digital wallets offer convenience, organization, and security. They store multiple payment methods in one place, streamline the checkout process, and often include encryption and tokenization for added security.

▼

Mobile payments provide access to financial services for individuals without traditional bank accounts. They facilitate remittances, microfinance, and other financial services through mobile platforms, promoting economic inclusion.

▼

We can expect greater AI integration for fraud detection, the potential rise of central bank digital currencies (CBDCs), and enhanced personalization. These trends aim to make mobile payments more seamless, secure, and user-friendly.

Conclusion

The innovations in mobile payment technologies are revolutionizing how US consumers handle transactions, offering increased convenience and security. As technology continues to evolve, understanding these advancements helps consumers and businesses alike leverage the benefits while addressing potential concerns.