Fintech Disruption: New Banking Models & Consumer Opportunities

Fintech is revolutionizing traditional banking by introducing innovative technologies like mobile banking, digital payments, and AI-driven financial services, creating new opportunities for consumers through increased accessibility, personalized experiences, and competitive pricing.

The financial technology (**fintech**) revolution is reshaping the landscape of traditional banking models and offering unprecedented opportunities for consumers.

Understanding the Fintech Revolution in Banking

Fintech, short for financial technology, is no longer a futuristic concept; it’s a present-day reality profoundly impacting how we interact with money and financial services. Its emergence has not only challenged traditional banking models but also unlocked new avenues for consumers seeking more efficient, accessible, and personalized financial solutions.

What Exactly is Fintech?

Fintech encompasses a wide array of technological innovations applied to the financial services industry. From mobile payments and online lending to robo-advisors and blockchain-based solutions, fintech leverages technology to streamline processes, reduce costs, and enhance the customer experience.

The Rise of Digital Banking

One of the most visible impacts of fintech is the rise of digital banking. Online and mobile banking platforms have become increasingly sophisticated, offering a seamless and convenient alternative to traditional brick-and-mortar branches. This shift has empowered consumers to manage their finances from anywhere, at any time.

- Mobile Banking Apps: Offering instant access to account information, transaction history, and payment options.

- Online Lending Platforms: Providing faster and more accessible loan application processes.

- Robo-Advisors: Automating investment management and providing personalized financial advice.

- Digital Payment Solutions: Facilitating seamless and secure online transactions.

In essence, fintech is democratizing financial services, making them more accessible, affordable, and user-friendly for a broader range of consumers.

Disrupting Traditional Banking Models

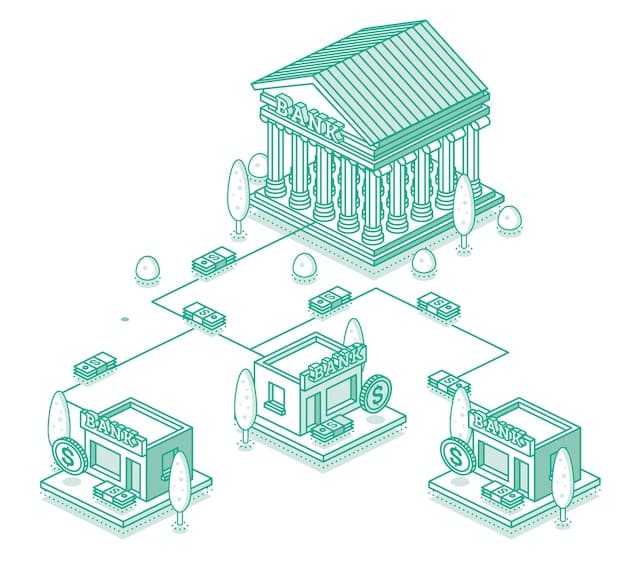

The rise of fintech has undeniably disrupted traditional banking models. Banks, once the undisputed gatekeepers of financial services, are now facing competition from agile and innovative fintech companies that are rapidly reshaping the industry.

Challenging Traditional Banking Practices

Fintech companies are challenging traditional banking practices by offering niche services that cater to specific customer needs. They often leverage data analytics and machine learning to provide personalized financial solutions that traditional banks struggle to match.

Reduced Overhead and Operational Efficiency

Fintech companies typically have lower overhead costs compared to traditional banks, as they don’t have the expenses associated with maintaining physical branches. This allows them to offer more competitive pricing and innovative products.

The integration of technology also streamlines operations, making processes more efficient and reducing the reliance on manual labor.

The Impact on Customer Experience

Fintech has placed a strong emphasis on customer experience, offering user-friendly interfaces and personalized services. This focus has raised the bar for the entire financial industry, forcing traditional banks to invest in improving their own customer experience.

- Personalized Financial Advice: Using AI to provide tailored recommendations based on individual financial goals.

- Faster Loan Approvals: Streamlining the application process and leveraging data analytics for quicker decisions.

- Seamless Mobile Payments: Enabling convenient and secure transactions via smartphones.

- 24/7 Customer Support: Offering instant assistance through chatbots and online channels.

The disruption caused by fintech has forced traditional banks to reevaluate their strategies and embrace innovation to remain competitive in the evolving financial landscape.

New Opportunities for Consumers

The disruption of traditional banking models by fintech has created a wealth of new opportunities for consumers. These opportunities span various aspects of financial services, offering greater access, convenience, and personalization.

Increased Accessibility and Financial Inclusion

Fintech has significantly increased accessibility to financial services, particularly for underserved populations. Mobile banking and digital payment platforms have enabled individuals in remote areas or with limited access to traditional banks to participate in the financial system.

Personalized Financial Solutions

Fintech companies are leveraging data analytics and AI to offer personalized financial solutions tailored to individual needs and preferences. This includes personalized investment advice, customized loan products, and targeted financial education resources.

By analyzing user data and behavior, fintech platforms can gain insights into individual financial habits and offer recommendations that align with specific financial goals.

Greater Transparency and Control

Fintech platforms often provide greater transparency and control over financial transactions. Mobile banking apps allow users to track their spending in real-time, set budgets, and receive alerts for unusual activity.

This increased transparency empowers consumers to make more informed financial decisions and take control of their financial well-being.

- Budgeting Tools: Helping users track their spending and identify areas for savings.

- Investment Apps: Enabling individuals to invest in the stock market with minimal fees and personalized guidance.

- Peer-to-Peer Lending: Connecting borrowers directly with lenders, offering competitive interest rates.

- Financial Education Resources: Providing access to educational content and tools to improve financial literacy.

The opportunities created by fintech empower consumers to take charge of their financial lives and achieve their financial goals with greater ease and efficiency.

The Role of AI and Machine Learning

Artificial Intelligence (AI) and machine learning are playing a pivotal role in driving innovation within the fintech industry. These technologies are enabling fintech companies to automate processes, enhance decision-making, and provide more personalized services.

Automating Processes and Reducing Costs

AI and machine learning can automate repetitive tasks such as fraud detection, customer service, and loan processing. This automation reduces operational costs and allows fintech companies to focus on innovation and customer engagement.

Chatbots powered by AI can handle routine customer inquiries, freeing up human agents to address more complex issues.

Data-Driven Decision Making

AI and machine learning algorithms can analyze vast amounts of data to identify patterns and trends that humans might miss. This enables fintech companies to make more informed decisions related to credit risk assessment, investment management, and fraud prevention.

For example, AI-powered credit scoring models can assess creditworthiness more accurately than traditional methods, leading to more inclusive lending practices.

Enhanced Customer Experience

AI and machine learning can personalize the customer experience by providing tailored recommendations, customized offers, and targeted financial advice. These technologies can also enhance security by detecting and preventing fraudulent transactions in real-time.

- Personalized Banking Apps: Offering tailored financial advice and product recommendations based on individual financial goals.

- Automated Fraud Detection: Using machine learning to identify and prevent fraudulent transactions in real-time.

- AI-Powered Chatbots: Providing instant customer support and resolving routine inquiries.

- Algorithmic Trading: Automating investment decisions based on market trends and risk tolerance.

The continued advancement of AI and machine learning will undoubtedly shape the future of fintech and further enhance the opportunities available to consumers.

Challenges and Considerations

While fintech offers numerous benefits, it’s essential to acknowledge the challenges and considerations that come with its rapid growth. These include regulatory compliance, data security, and ethical concerns.

Regulatory Landscape

The regulatory landscape for fintech is still evolving, and companies must navigate a complex web of rules and regulations that vary from country to country. Compliance with these regulations can be costly and time-consuming, particularly for smaller fintech startups.

Regulators are working to create a framework that fosters innovation while protecting consumers and ensuring the stability of the financial system.

Data Security and Privacy

Fintech companies handle vast amounts of sensitive data, making them attractive targets for cyberattacks. Data breaches can have severe consequences, including financial losses for consumers and reputational damage for the company.

Robust data security measures are essential to protect consumer information and maintain trust.

Ethical Considerations

The use of AI and machine learning in fintech raises ethical concerns related to bias, fairness, and transparency. Algorithmic bias can lead to discriminatory outcomes in lending and other financial services.

It’s crucial for fintech companies to ensure that their algorithms are fair, transparent, and accountable.

- Cybersecurity Threats: Protecting sensitive financial data from hackers and data breaches.

- Regulatory Uncertainty: Navigating the evolving legal and regulatory landscape for fintech.

- Algorithmic Bias: Ensuring that AI algorithms are fair and do not discriminate against certain groups.

- Financial Literacy: Educating consumers about the risks and benefits of using fintech products and services.

Addressing these challenges is crucial to fostering a sustainable and responsible fintech ecosystem that benefits both consumers and the industry as a whole.

The Future of Banking with Fintech

The integration of fintech into traditional banking models is expected to continue and accelerate in the coming years. This will lead to a more interconnected, personalized, and efficient financial ecosystem.

Collaboration Between Fintechs and Banks

Increasingly, traditional banks are recognizing the value of partnering with fintech companies to leverage their innovative technologies and reach new customers. These collaborations can result in win-win scenarios, with banks benefiting from fintech’s agility and technological expertise, and fintechs gaining access to banks’ resources and customer base.

Emerging Technologies

Emerging technologies such as blockchain, decentralized finance (DeFi), and quantum computing have the potential to further disrupt the financial industry. Blockchain can enable secure and transparent transactions, while DeFi offers new ways to access financial services without intermediaries.

The Rise of Hyper-Personalization

As AI and machine learning become more sophisticated, we can expect to see a rise in hyper-personalization in financial services. This means that consumers will receive highly customized financial advice, product recommendations, and service offerings tailored to their individual needs and preferences.

- Open Banking: Enabling seamless data sharing between banks and fintech companies to create innovative services.

- Decentralized Finance (DeFi): Offering new ways to access financial services without intermediaries.

- Blockchain Technology: Revolutionizing payments, lending, and asset management with secure and transparent transactions.

- Hyper-Personalization: Providing highly customized financial advice and product recommendations based on individual needs.

The future of banking is likely to be characterized by a seamless integration of traditional and innovative technologies, empowering consumers with greater control, convenience, and access to financial services.

| Key Point | Brief Description |

|---|---|

| 📱 Mobile Banking | Conveniently manage finances anywhere. |

| 🤖 AI in Fintech | Automates processes, enhances customer experience. |

| 🔒 Data Security | Critical to protect consumer financial data. |

| 🤝 Fintech Collaboration | Partnerships enhance innovation and reach. |

Frequently Asked Questions

Fintech includes technology innovations applied to financial services. It challenges traditional banking by offering efficient digital solutions and driving banks to innovate.

Fintech increases accessibility through mobile banking, digital payment platforms, and online lending, reaching underserved areas with limited access to traditional banks.

AI and machine learning automate processes, detect fraud, and personalize financial advice, enhancing decision-making and customer experience within fintech platforms.

Key challenges include navigating regulatory compliance, ensuring data security, addressing ethical concerns related to algorithmic bias, and improving financial literacy among consumers.

The future of banking will likely involve seamless integration of innovative and traditional technologies, offering consumers greater control, convenience, and access to financial services through fintech.

Conclusion

In conclusion, fintech’s disruption of traditional banking models has unlocked unprecedented opportunities for consumers, offering increased accessibility, personalization, and efficiency. While challenges remain, the continued integration of fintech promises a more interconnected and user-friendly financial ecosystem.