NFT Royalties in the US: Navigating the Legal Maze and Revenue Streams

NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications involves navigating complex regulations and revenue distribution models. This article explores the current legal environment and the financial impact on creators and marketplaces.

The world of Non-Fungible Tokens (NFTs) has revolutionized digital ownership, but it also introduced new complexities, especially concerning royalties. NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications is crucial for creators, collectors, and marketplaces alike.

Let’s delve into the intricacies of royalty structures, recent legal challenges, and the impact on revenue streams within the US NFT ecosystem.

Understanding the Basics of NFT Royalties in the US: The Foundation

Before diving into the legal intricacies, it’s essential to grasp the basics of how NFT royalties function.

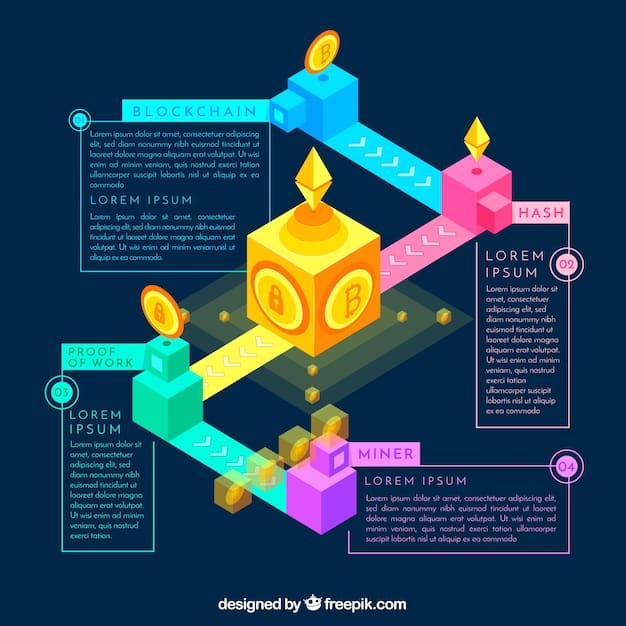

NFT royalties are essentially a percentage of the resale price of an NFT that is automatically paid to the original creator each time the NFT is sold on a secondary market.

How NFT Royalties Work

NFT royalties are typically programmed into the smart contract of the NFT. This means that every time the NFT is sold on a platform that supports royalties, the specified percentage is automatically distributed to the creator’s wallet. This system ensures that creators can continue to benefit financially from their work, even after the initial sale.

- Royalties are encoded in the smart contract.

- Payments are automatic and transparent.

- Creators benefit from secondary market sales.

The typical royalty rates range from 2.5% to 10%, but this can vary depending on the platform and the creator’s preferences. The introduction of royalties has been a game-changer for digital artists, musicians, and other creators, offering a sustainable revenue model in the digital space.

Understanding this foundational aspect is essential before we can better grasp the complexities of NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications.

The Legal Landscape: NFT Royalties and US Regulations

Navigating the legal landscape surrounding NFT royalties in the US is complex. Given NFTs’ novelty, current regulations are still evolving and are often unclear about their status within existing legal frameworks.

The lack of specific NFT legislation means current laws, such as those governing copyright, intellectual property, and securities, are being applied, often leading to uncertainty.

Copyright and Royalties

Copyright law plays a significant role in determining the extent to which creators can enforce their royalty rights. If an NFT contains copyrighted material, the creator’s ability to claim royalties on secondary sales may depend on the terms of the initial sale and any transfer of copyright ownership.

The US Copyright Office is actively studying how copyright law should apply to NFTs, but definitive guidelines are still in development. Until these guidelines are established, creators and platforms must navigate a gray area, potentially leading to disputes over royalty payments.

The Issue of Enforceability

One of the major challenges in the US legal landscape is enforcing NFT royalties. While the smart contracts are designed to automatically execute royalty payments, some NFT marketplaces have experimented with optional royalties or even removed them altogether.

This has led to significant debate within the NFT community, with some arguing that enforcing royalties is essential for supporting creators, while others believe that marketplaces should have the freedom to set their own terms.

- Smart contract enforceability varies across platforms.

- Legal challenges to royalty enforcement are growing.

- Community debates impact market practices.

The challenges surrounding enforceability are a crucial aspect of NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications, as it directly affects the financial viability for creators.

Revenue Implications: How NFT Royalties Impact Creators and Platforms

NFT royalties significantly impact creators and platforms involved in the NFT ecosystem.

For creators, royalties can provide a sustainable income stream, allowing them to continue creating and innovating. For platforms, the decision to support or forgo royalties can impact their attractiveness to creators and collectors.

Creator Dependency on Royalties

Many digital artists and musicians rely on royalty income to support their work. The ability to earn a percentage of secondary sales provides a financial incentive and encourages creators to continue producing high-quality NFTs.

However, the volatility of the NFT market and the inconsistent enforcement of royalties means that creators face uncertainty in relying solely on this revenue stream. Diversification of income through multiple NFT projects and other forms of digital content creation is a common strategy to mitigate this risk.

Platform Perspectives

NFT marketplaces play a key role in shaping the revenue landscape. Platforms that enforce royalties may attract more creators, but they might also face criticism from collectors who prefer lower transaction costs. Some platforms have experimented with different royalty models, such as allowing creators to set their royalty rates or offering tiered royalty systems based on sales volume.

- Platforms balance creator incentives and collector preferences.

- Different royalty models impact platform competitiveness.

- Market volatility affects royalty income stability.

The revenue implications are central to NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications, as the financial incentives for both creators and platforms shape market behavior.

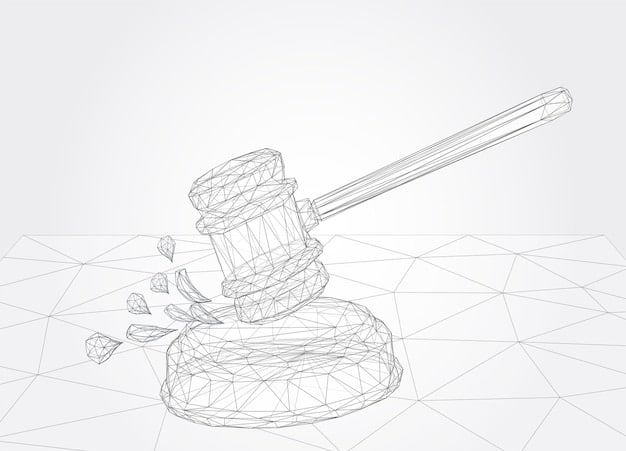

Recent Legal Challenges and Court Cases

Several recent legal challenges and court cases have brought the topic of NFT royalties to the forefront.

These cases often revolve around copyright infringement, fraud, and the enforceability of smart contracts. The outcomes of these cases could set important precedents for regulating NFTs and protecting creators’ rights.

Notable Cases

One notable case involved a dispute over the unauthorized minting and sale of NFTs that infringed on copyrighted artwork. The court ruled in favor of the original artist, highlighting the importance of copyright protection in the NFT space.

Another case focused on a fraudulent NFT project where the creators promised royalty payments but failed to deliver. The court held the creators accountable, underscoring the need for transparency and accountability in the NFT market.

Impact on Future Regulations

These legal challenges highlight the need for clear and comprehensive regulations governing NFTs. As courts grapple with these novel issues, their decisions will shape the future legal landscape for NFT royalties in the US.

Industry stakeholders, including creators, platforms, and legal experts, are closely monitoring these developments and advocating for policies that balance innovation with creator protection.

- Court cases clarify copyright and fraud issues.

- Outcomes influence future regulatory approaches.

- Stakeholder advocacy shapes policy debates.

It’s imperative to understand recent legal challenges to assess NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications fully.

Future Trends and Predictions for NFT Royalties in the US

The future of NFT royalties in the US is uncertain, but several trends and predictions offer insights into how the landscape may evolve.

Technological innovations, regulatory developments, and market dynamics will all play a role in shaping the future of NFT royalties.

Technological Advancements

New technologies, such as enhanced smart contracts and decentralized autonomous organizations (DAOs), could revolutionize how royalties are managed and enforced. Enhanced smart contracts could provide more flexible and customizable royalty terms.

DAOs could enable creators to collectively manage and distribute royalty income, fostering greater transparency and community governance. These technologies could empower creators and address some of the current challenges in the NFT ecosystem.

Regulatory Scenarios

The US government could introduce specific regulations to clarify the legal status of NFTs and protect creators’ rights to royalties. A clear regulatory framework could provide greater certainty and encourage more widespread adoption of NFTs.

Alternatively, the government could take a hands-off approach, allowing the market to self-regulate. The outcome will depend on the level of consensus among policymakers and industry stakeholders.

- Technological innovations enhance royalty management.

- Regulatory clarity fosters market growth.

- Market dynamics influence royalty practices.

Considering these future trends is vital to understanding NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications over the long term.

| Key Point | Brief Description |

|---|---|

| 💰 NFT Royalties | Percentage of resale price paid to the creator. |

| ⚖️ Legal Uncertainty | Regulations are still evolving; current laws applied. |

| 🧑🎨 Creator Impact | Provides income but faces market volatility. |

| 🔮 Future Trends | Technological and regulatory developments are key. |

Frequently Asked Questions

NFT royalties are automated payments to the original creator each time an NFT is resold. They are encoded in the smart contract and offer a percentage of the sale price, supporting creators’ continued revenue.

NFT royalties are enforced through smart contracts on platforms that support the royalty standard. However, enforcement can be inconsistent as some marketplaces allow optional royalties or remove them entirely.

Legal challenges include copyright infringement, fraud, and the enforceability of smart contracts. Court cases are shaping the regulatory environment, and uncertainties persist due to the novelty of NFTs.

Royalties can provide a vital revenue source, incentivizing ongoing content creation. However, market volatility makes it difficult for creators to rely solely on royalty income, so diversification is crucial.

Future trends include technological advancements like enhanced smart contracts, regulatory developments to clarify NFT laws, and market dynamics influencing royalty payment practices across different platforms.

Conclusion

NFT Royalties in the US: Understanding the Latest Legal Landscape and Revenue Implications is an evolving field. As technology advances and regulations become clearer, both creators and platforms will need to stay informed to navigate this dynamic landscape effectively.

By understanding the legal and financial implications, stakeholders can ensure that NFT royalties continue to support sustainable and equitable growth in the digital art and collectibles market.