How Open Banking APIs Will Transform US Personal Finance by 2025

How will open banking APIs redefine US personal finance by 2025? They will enable increased financial data access, personalized services, and innovative products, influencing how Americans manage their money, access credit, and invest, fostering a more competitive and inclusive financial ecosystem.

The financial landscape in the United States is on the cusp of a significant transformation. How will open banking APIs redefine US personal finance by 2025? The answer lies in the potential to revolutionize how consumers interact with their financial data and services.

This article explores the multifaceted ways in which open banking APIs are set to reshape the US personal finance sector, offering a glimpse into a future where financial services are more accessible, personalized, and empowering.

Understanding Open Banking APIs

Open Banking APIs are fundamentally changing how financial institutions share data and interact with third-party developers. This section introduces the core concepts of open banking and the role APIs play in this evolving ecosystem.

Open banking represents a paradigm shift towards greater transparency and collaboration in the financial sector.

What are APIs and How Do They Work?

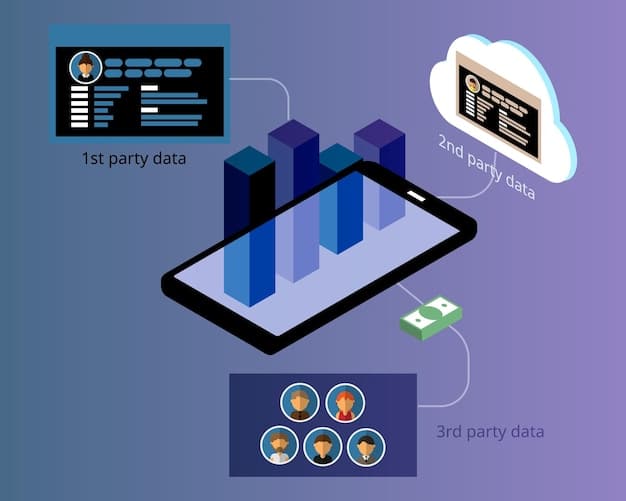

APIs (Application Programming Interfaces) serve as bridges between different software systems, enabling them to communicate and exchange data. In the context of open banking, APIs allow authorized third-party developers to access customer financial data held by banks and other financial institutions, with the customer’s explicit consent.

- APIs enable secure data transfer between different platforms.

- They standardize how applications interact with each other.

- APIs allow for innovation by enabling third-party developers to build new services.

- They empower customers with greater control over their financial data.

This controlled data sharing allows for the creation of innovative financial products and services tailored to individual customer needs.

Personalized Financial Services

One of the most significant impacts of open banking APIs lies in the potential for personalized financial services. By accessing and analyzing customer data, financial institutions and fintech companies can offer tailored solutions that cater to individual needs.

This level of personalization was previously unattainable, leaving consumers with a one-size-fits-all approach to finance.

AI-Driven Financial Advice

Open banking APIs enable the development of AI-powered financial advisors that can analyze a user’s spending habits, income, and financial goals to provide customized recommendations on budgeting, saving, and investing.

These AI-driven advisors can offer continuous monitoring and adjustments to financial plans, ensuring they remain aligned with the user’s evolving needs and market conditions.

- Personalized budgeting tools adapt to individual spending patterns.

- AI-driven robo-advisors offer customized investment strategies.

- Proactive alerts help users avoid overdraft fees and late payments.

This proactive approach empowers users to make informed financial decisions and achieve their goals more effectively. As we look at How will open banking APIs redefine US personal finance by 2025?, personalized advice is a key component.

Enhanced Access to Credit

Open banking APIs can also revolutionize how credit is accessed and evaluated. By providing lenders with a more complete picture of an applicant’s financial history, APIs can enable more accurate credit scoring and expand access to credit for underserved populations.

Traditional credit scoring models often rely on limited data, potentially excluding individuals with non-traditional income sources or limited credit histories.

Alternative Credit Scoring Models

Open banking APIs allow lenders to incorporate a wider range of data points, such as transaction history, payment behavior, and savings patterns, into credit scoring models. This holistic approach can lead to more accurate risk assessments and fairer lending decisions.

Furthermore, open banking APIs can streamline the loan application process, reducing paperwork and approval times, making it easier for individuals and small businesses to access the capital they need.

- Faster loan application process through automated data verification.

- More accurate credit scoring based on comprehensive financial data.

- Increased access to credit for individuals with limited credit history.

By 2025, it is projected that open banking APIs will be the norm for many lenders. The shift from traditional methods will be dramatic and, ideally, equitable.

Streamlined Payments and Transactions

Open banking APIs are also poised to transform the payments landscape, enabling faster, more secure, and more convenient transactions. This section explores the innovative payment solutions that open banking APIs are making possible.

Traditional payment methods often involve intermediaries, leading to delays and higher transaction costs.

Account Aggregation Services

APIs will drive account aggregation services. By connecting directly to bank accounts, open banking APIs will facilitate real-time payments, bypassing traditional card networks and reducing transaction fees. These APIs also enable seamless cross-border payments.

This innovative payment infrastructure has the potential to disrupt the existing payments ecosystem, bringing greater efficiency and cost savings to both consumers and businesses.

- Real-time payments directly from bank accounts.

- Reduced transaction fees by eliminating intermediaries.

- Secure and seamless cross-border payments.

For consumers, this translates to a more convenient and affordable payment experience. Thinking about How will open banking APIs redefine US personal finance by 2025?, smoother transactions are definitely part of the equation.

Data Security and Privacy

While open banking APIs offer numerous benefits, ensuring the security and privacy of customer data is paramount. This section examines the security measures and regulations that are being implemented to protect consumer financial information in the open banking ecosystem.

Data breaches and privacy violations are significant concerns in the digital age, particularly when it comes to financial data.

Regulatory Oversight and Standards

To mitigate these risks, regulators and industry bodies are establishing robust security and privacy standards. These standards include requirements for strong authentication, data encryption, and data access controls. Consumers must also be given clear and transparent information about how their data is being used and have the right to revoke access at any time.

By prioritizing security and privacy, the open banking ecosystem can build trust with consumers and foster widespread adoption. Open banking providers must use encryption techniques.

- Strong authentication protocols to verify user identity.

- Data encryption to protect sensitive information.

- Data access controls to limit unauthorized access.

These privacy protections are essential for ensuring the long-term success of open banking. As 2025 approaches, compliance will be critical.

The Future of Open Banking in the US

Looking ahead, the potential of open banking in the US is vast. This section explores the emerging trends and opportunities that are likely to shape the future of open banking and its impact on personal finance.

The open banking landscape is constantly evolving, with new technologies and business models emerging regularly.

New Fintech Innovations

Further development and refinement of How will open banking APIs redefine US personal finance by 2025? will drive innovation. We will see new and exciting fintech products that will change banking. As open banking APIs mature and become more widely adopted, we can expect to see a proliferation of innovative financial products and services.

These innovations will range from personalized financial management tools to AI-powered investment platforms, all designed to empower consumers and improve their financial well-being.

- Expansion of open banking APIs to new financial products and services.

- Integration of open banking APIs with other emerging technologies.

- Increased collaboration between banks and fintech companies.

Open banking APIs are likely to play a central role in shaping the future of personal finance in the US. The full impact on the US will be realized.

| Key Point | Brief Description |

|---|---|

| 🚀 Personalized Services | Tailored advice with AI based on financial data. |

| 💳 Enhanced Credit Access | Better credit scoring using more financial info. |

| 💸 Streamlined Transactions | Real-time payments and reduced fees. |

Frequently Asked Questions

Open banking APIs are secure interfaces that enable third-party developers to access customer financial data from banks and other institutions, with the customer’s consent, driving innovation.

By allowing data sharing, open banking enables personalized services, streamlined payments, and better access to credit, leading to more efficient and customer-centric financial solutions.

By 2025, open banking is expected to provide more customized options while also changing how people handle investments. The API framework has the potential to simplify current financial infrastructures.

Yes, open banking incorporates robust security measures, including strong authentication, data encryption, and strict access controls, ensuring that customer financial information is protected.

The benefits of how will open banking APIs redefine US personal finance by 2025, would be inclusive. API banking not only benefits consumers and financial institutions, but also fintech startups.

Conclusion

In conclusion, open banking APIs are poised to revolutionize US personal finance by 2025. These APIs offer the potential to create more personalized services, enhance access to credit, streamline payments, and foster greater financial inclusion.

While challenges remain, particularly around data security and privacy, the opportunities presented by open banking are too significant to ignore. As the US embraces the open banking movement, consumers can look forward to a future where financial services are more accessible, affordable, and tailored to their individual needs.