How Fintech Innovations Are Reshaping US Real Estate Investment

How are Fintech Innovations Transforming the US Real Estate Investment Landscape? Fintech innovations are revolutionizing US real estate investment by streamlining processes, increasing accessibility, and enhancing data-driven decision-making.

The US real estate investment landscape is undergoing a significant transformation, fueled by the emergence of innovative financial technologies. But, How are Fintech Innovations Transforming the US Real Estate Investment Landscape? These technologies are not just incremental improvements; they represent a fundamental shift in how real estate transactions are conducted and investments are managed. Let’s delve into the specific ways fintech is revolutionizing this sector.

How are Fintech Innovations Transforming the US Real Estate Investment Landscape?

Fintech innovations are rapidly reshaping various sectors, and real estate is no exception. In the US, the integration of financial technology is revolutionizing how properties are bought, sold, managed, and financed. These advancements are not only streamlining processes but also opening up new opportunities for investors.

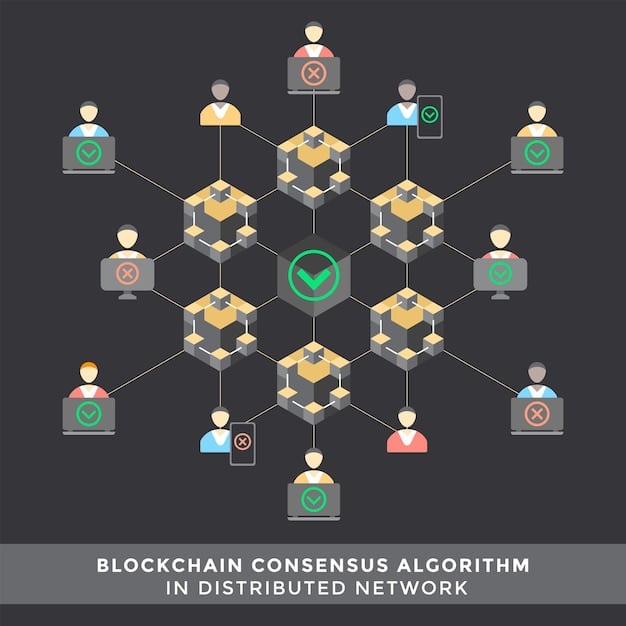

Streamlining Transactions with Blockchain

Blockchain technology is enabling more secure and transparent real estate transactions. This technology can simplify the process of transferring property titles and reduce the risk of fraud.

- Reduced Paperwork: Blockchain eliminates the need for extensive paperwork, making transactions faster and more efficient.

- Enhanced Security: The decentralized nature of blockchain ensures that records are tamper-proof and secure.

- Faster Closings: By automating many steps in the closing process, blockchain can significantly reduce the time it takes to complete a real estate transaction.

The adoption of blockchain in real estate is still in its early stages, but its potential to transform the industry is immense. As more companies begin to leverage this technology, we can expect to see even greater efficiencies and security in real estate transactions.

In summary, blockchain offers a more secure, efficient, and transparent way to manage real estate transactions, positively impacting the overall investment landscape.

Online Real Estate Platforms and Crowdfunding

Online real estate platforms and crowdfunding have democratized real estate investment, making it accessible to a wider range of investors. These platforms allow individuals to invest in properties with smaller amounts of capital, diversifying their portfolios and participating in projects that were previously out of reach.

Accessibility for Small Investors

Crowdfunding platforms enable small investors to pool their resources and invest in larger projects, such as apartment complexes or commercial developments. This level of accessibility was previously unavailable, opening up new opportunities for wealth creation.

- Lower Entry Barriers: Investors can start with as little as a few hundred dollars, making real estate investment more inclusive.

- Diversification: Online platforms allow investors to spread their capital across multiple projects, reducing risk.

- Transparency: These platforms provide detailed information about investment opportunities, including financial projections and property details.

Online real estate platforms and crowdfunding are leveling the playing field, bringing real estate investment opportunities to a broader audience. This shift is not only benefiting individual investors but also providing developers with new sources of capital.

These platforms have changed the dynamics of real estate investing, giving individual investors unprecedented access to a diverse range of opportunities. This approach enhances portfolio diversification and wealth creation.

AI and Machine Learning in Property Valuation

Artificial intelligence (AI) and machine learning are transforming property valuation by providing more accurate and data-driven assessments. Traditional methods of property valuation often rely on manual appraisals and limited data sets, which can be subjective and time-consuming. AI and machine learning algorithms can analyze vast amounts of data to generate more reliable valuations.

Improved Accuracy and Efficiency

AI-powered valuation models can consider a wide range of factors, including market trends, property characteristics, and comparable sales, to arrive at a more precise valuation. This increased accuracy can help investors make better-informed decisions.

- Data-Driven Insights: AI algorithms can identify patterns and trends that might be missed by human analysts.

- Reduced Bias: By relying on data rather than subjective opinions, AI can minimize bias in property valuations.

- Faster Appraisals: AI can automate many steps in the appraisal process, speeding up the time it takes to value a property.

AI and machine learning are bringing greater objectivity and efficiency to property valuation, empowering investors with more reliable information. This technology is reshaping the real estate investment landscape by facilitating more informed decisions and reducing the risk of overvaluation or undervaluation.

In essence, the integration of AI and machine learning in property valuation offers a more accurate, efficient, and unbiased assessment of property values, helping investors make smarter choices.

Digital Mortgages and Loan Origination

Digital mortgages and loan origination are streamlining the process of obtaining financing for real estate investments. Fintech companies are leveraging technology to simplify the application process, reduce paperwork, and provide faster approvals.

Simplifying the Mortgage Process

Online mortgage platforms allow borrowers to apply for loans from anywhere, at any time. These platforms often use automated underwriting systems to assess risk and approve loans more quickly than traditional lenders.

- Online Applications: Borrowers can complete the entire mortgage application process online, eliminating the need for in-person visits.

- Automated Underwriting: AI-powered systems can analyze credit scores, income, and other factors to make faster loan decisions.

- Faster Approvals: Digital mortgages can be approved in a matter of days, compared to the weeks or months it can take with traditional lenders.

Digital mortgages and loan origination are making it easier and faster to obtain financing for real estate investments. This shift is not only benefiting borrowers but also creating new opportunities for lenders to reach a wider audience and reduce their operating costs.

This technological advancement streamlines the loan process, speeds up approvals, and makes mortgage financing more accessible to a wider range of borrowers, improving the overall real estate investment experience.

The Rise of PropTech Companies

PropTech companies are driving innovation across the entire real estate industry, from property management to construction. These companies are using technology to address a wide range of challenges and create new opportunities for growth.

Innovation in Property Management

PropTech companies are developing new tools for managing properties more efficiently, such as online rent collection, automated maintenance requests, and tenant screening services. These tools can help landlords reduce their operating costs and improve tenant satisfaction.

- Automated Rent Collection: Online platforms make it easier for tenants to pay rent and for landlords to track payments.

- Smart Home Integration: IoT devices and smart home technologies can enhance property values and improve tenant experiences.

- Predictive Maintenance: AI algorithms can analyze data from building systems to predict maintenance needs and prevent costly repairs.

PropTech companies are revolutionizing the way properties are managed, making it easier and more efficient for landlords to operate their businesses. These innovations are not only benefiting property owners but also enhancing the experiences of tenants.

Challenges and Future Outlook

While fintech innovations are transforming the US real estate investment landscape, there are also challenges to consider. Regulatory hurdles, data security concerns, and the need for greater adoption are some of the obstacles that must be addressed.

Addressing Regulatory and Data Security Concerns

As fintech companies continue to disrupt the real estate industry, it is important to ensure that regulations keep pace with innovation. Additionally, protecting sensitive data is paramount, and companies must invest in robust security measures to prevent breaches.

- Regulatory Clarity: Clear and consistent regulations are needed to foster innovation while protecting consumers and investors.

- Data Security: Fintech companies must prioritize data security and implement measures to safeguard sensitive information.

- Greater Adoption: Overcoming resistance to change and encouraging greater adoption of fintech solutions is crucial for realizing the full potential of these technologies.

By addressing these challenges, the US real estate investment landscape can continue to benefit from the transformative power of fintech innovations. The future of real estate investment is undoubtedly linked to the ongoing integration of technology, and those who embrace these changes will be best positioned for success. Understanding how are Fintech Innovations Transforming the US Real Estate Investment Landscape? is crucial for anyone involved in the industry.

Despite existing challenges, the collaboration of fintech and real estate investments is set to grow even more, offering increased efficiency, transparency, and opportunities for investors and businesses involved.

| Key Point | Brief Description |

|---|---|

| 🚀 Blockchain Adoption | Enhances security & transparency in real estate transactions. |

| 🏘️ Crowdfunding Platforms | Opens real estate investments to a wider range of investors. |

| 🤖 AI Property Valuation | Improves accuracy & efficiency in assessing property values. |

| 💳 Digital Mortgages | Streamlines the mortgage process with quicker approvals. |

Frequently Asked Questions

Blockchain enhances security and transparency in real estate transactions by eliminating paperwork and streamlining the process, making it tamper-proof and efficient.

Online platforms and crowdfunding break down barriers by allowing smaller investments, diversifying portfolios, and providing detailed financial information for informed decisions.

AI and machine learning algorithms offer data-driven property valuations, providing more accurate and unbiased assessments that minimize subjectivity and reduce the risk of overvaluation.

Digital mortgages simplify the application and approval processes, speeding up loan decisions. Automated underwriting systems quickly assess risk, improving accessibility and convenience for borrowers.

Challenges include regulatory and data security concerns. Clear regulations and robust security are needed to foster innovation while assuring the protection of investors and sensitive information.

Conclusion

The convergence of fintech and real estate investment is reshaping the industry, offering increased efficiency, transparency, and opportunities. Understanding how are Fintech Innovations Transforming the US Real Estate Investment Landscape? is crucial for investors and businesses.