How US Fintechs Leverage APIs for Seamless Financial System Integration

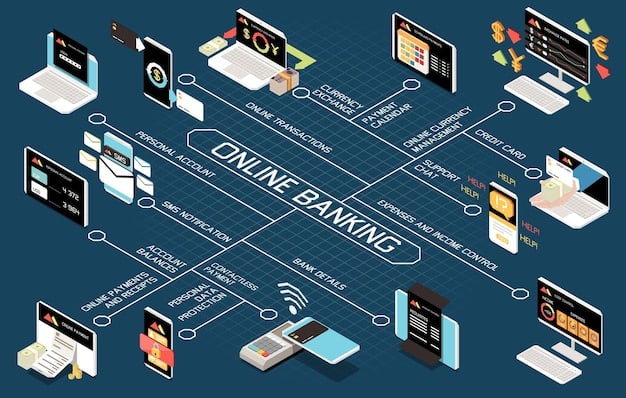

How Can US Fintech Companies Use APIs to Integrate with Existing Financial Systems? Application Programming Interfaces (APIs) enable fintechs to connect with traditional financial institutions, accessing data and services to offer innovative solutions, streamline operations, and enhance customer experiences.

The financial technology (fintech) sector in the United States is rapidly evolving, driven by innovation and a desire to provide more efficient and accessible financial services. But how can US fintech companies use APIs to integrate with existing financial systems to bring about this change? The answer lies in Application Programming Interfaces (APIs), which act as bridges between different software systems, enabling them to communicate and exchange data seamlessly.

APIs are vital for fintechs looking to disrupt the traditional financial landscape. By leveraging APIs, fintechs can access a wealth of data and functionality from established financial institutions, allowing them to create innovative products and services. Let’s explore the depths of how this works.

Understanding the Role of APIs in Fintech Integration

APIs are the backbone of modern fintech integration. They allow different software systems to communicate and share data, enabling fintech companies to access existing financial infrastructure.

What are APIs and How Do They Work?

APIs are sets of protocols and tools that allow different software applications to interact with each other. They define the methods and data formats that applications can use to request and exchange information.

Benefits of Using APIs for Fintech Companies

Using APIs provides numerous advantages for fintech companies, including faster development times, reduced costs, and increased innovation. They enable fintechs to focus on creating value-added services rather than building infrastructure from scratch.

- Accelerated Innovation: APIs allow fintechs to quickly integrate new features and services.

- Reduced Development Costs: Utilizing existing APIs saves time and resources.

- Enhanced User Experience: Seamless integration leads to better, more cohesive services.

- Data Accessibility: APIs provide access to valuable financial data for informed decision-making.

In the US, APIs play a crucial role in driving competition and innovation in the financial sector. They allow smaller fintech companies to compete with larger, established institutions by providing access to the same data and infrastructure. How can US fintech companies use APIs to integrate with existing financial systems and stay competitive? By identifying the right APIs and strategically integrating them into their business model.

Key Strategies for Fintech API Integration in the US

To effectively use APIs, fintech companies need to develop a clear integration strategy. This involves identifying the right APIs, understanding their capabilities, and implementing them in a secure and efficient manner.

Identifying the Right APIs for Your Fintech Business

The first step is to identify the APIs that align with your business goals. Consider what data and functionality you need to access and which APIs can provide it.

Ensuring Data Security and Compliance

Data security is paramount when integrating with existing financial systems. Ensure that you are using APIs that comply with industry standards and regulations.

- Implement robust authentication and authorization mechanisms.

- Encrypt data in transit and at rest.

- Regularly audit your API integrations for vulnerabilities.

- Comply with relevant regulations such as GDPR and CCPA.

US fintech companies must prioritize security and compliance when integrating APIs. Neglecting these aspects can lead to data breaches, regulatory fines, and reputational damage. So, how can US fintech companies use APIs to integrate with existing financial systems while maintaining the highest levels of security? By adopting a proactive approach, regularly assessing risks and maintaining robust security measures. The growing number of regulations in the financial services industry mean that your approach to API integration isn’t something that should be taken lightly. You should make sure that you know the ins and outs of any APIs you’re going to use and make sure that they comply with relevant laws.

Use Cases of API Integration in US Fintech

APIs are used in a variety of fintech applications, from payment processing to lending and investment management. Here are some specific examples of how APIs can be used to integrate with existing financial systems.

Payment Processing and Digital Wallets

APIs enable fintech companies to offer seamless payment processing solutions by integrating with banks and payment gateways.

Lending and Credit Scoring

APIs allow fintech lenders to access credit data and automate the loan application process. How can US fintech companies use APIs to integrate with existing financial systems and improve credit scoring? By leveraging APIs to access a wider range of data points, including alternative credit data and real-time transaction information.

- Automated loan application processing

- Improved credit risk assessment

- Faster loan disbursement

- Personalized loan offers

By using APIs, US fintech companies can create more efficient and customer-friendly lending platforms. This not only benefits consumers but also helps fintech lenders make better-informed decisions.

Banking as a Service (BaaS)

Banking as a Service (BaaS) platforms utilize APIs to allow fintechs to offer banking products without the need for a banking license. This enables fintech companies to quickly launch new financial services and reach a wider audience.

Challenges and Solutions in API Integration

While APIs offer significant benefits, there are also challenges to be aware of. These include security risks, compatibility issues, and the complexity of managing multiple API integrations.

Addressing Security Risks

Security is a major concern when integrating with APIs. Fintech companies need to implement robust security measures to protect against data breaches and cyberattacks.

Overcoming Compatibility Issues

APIs can vary in terms of their functionality, data formats, and security protocols. This can lead to compatibility issues that need to be addressed through careful planning and testing.

- Use API gateways to manage and secure API traffic.

- Implement standard data formats such as JSON and XML.

- Conduct thorough testing to identify and resolve compatibility issues.

- Adopt API versioning to ensure backward compatibility.

US fintech companies should prioritize interoperability and standardization when integrating APIs. This can help reduce the risk of compatibility issues and ensure that different systems can communicate effectively. So, how can US fintech companies use APIs to integrate with existing financial systems smoothly, even when faced with compatibility issues? By adhering to industry standards, leveraging API management tools, and investing in thorough testing.

The Future of Fintech API Integration

The future of fintech API integration is bright, with new technologies and standards emerging to make integration easier and more secure. As the fintech industry continues to evolve, APIs will play an increasingly important role in driving innovation and competition.

Emerging Technologies and Standards

New technologies such as GraphQL and WebAssembly are making APIs more efficient and flexible. These technologies enable developers to build APIs that are tailored to specific needs and that can run on a variety of platforms.

The Role of Open Banking

Open Banking initiatives are promoting the use of APIs to create more transparent and competitive financial markets. By requiring banks to provide access to their data through APIs, regulators are encouraging innovation and giving consumers more control over their financial information.

- Increased adoption of Open Banking standards.

- Greater use of AI and machine learning to enhance API functionality.

- Improved security and compliance through advanced authentication methods.

- More personalized and customer-centric financial services.

In the US, the adoption of Open Banking principles is gradually gaining momentum. This trend is expected to accelerate as more consumers demand greater control over their financial data and as fintech companies continue to innovate. By embracing Open Banking, US fintech companies can unlock new opportunities and deliver more value to their customers. Thinking ahead, how can US fintech companies use APIs to integrate with existing financial systems to take advantage of advancements in API technology? By investing in API development, adhering to emerging standards and adapting to the changing regulatory landscape.

| Key Aspect | Brief Description |

|---|---|

| 💡API Integration | Enables seamless data exchange between fintechs and financial systems. |

| 🔒 Security | Prioritizing data protection is crucial for regulatory compliance. |

| 🏦 BaaS | Banking as a Service allows fintechs to offer financial products. |

| 📊 Future Trends | Includes Open Banking, enhanced AI, and better security measures. |

Frequently Asked Questions

APIs (Application Programming Interfaces) are tools that allow different software systems to communicate and share data, enabling fintech companies to integrate with existing financial systems and create innovative solutions.

The primary security concerns involve potential data breaches, compliance issues, and cyberattacks, requiring fintech companies to implement strong security measures to protect sensitive financial data during integration.

Fintech companies can use APIs to connect with traditional banks, access essential data, and functionality, enabling them to offer new financial services like digital wallets, automated lending, and Banking as a Service (BaaS).

Open Banking promotes the use of APIs to foster more transparent and competitive financial markets, mandating banks to offer data access via APIs, driving innovation, and empowering users with better control over their financial data.

US fintech companies can anticipate emerging technologies such as GraphQL and WebAssembly improving API efficiency, alongside a greater emphasis on AI, machine learning, and enhanced security for API functionalities in the future.

Conclusion

In conclusion, APIs are indispensable tools for US fintech companies aiming to integrate with existing financial systems. By leveraging APIs, fintechs can drive innovation, reduce development costs, and deliver enhanced user experiences.

However, it is crucial to address the challenges associated with API integration, such as security risks and compatibility issues. By prioritizing security, adopting industry standards, and staying abreast of emerging trends, US fintech companies can unlock the full potential of APIs and thrive in the rapidly evolving financial landscape. How can US Fintech Companies Use APIs to Integrate with Existing Financial Systems? By strategically planning and proactively adapting to technological advancements and regulatory changes.