Gig Economy Scams: Spot & Avoid Fraudulent Opportunities

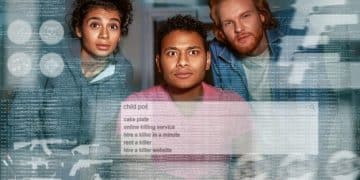

Gig economy scams are on the rise, targeting freelancers and independent contractors with fake job postings, phishing schemes, and payment fraud; protect yourself by recognizing red flags, verifying opportunities, and safeguarding your personal and financial information.

The gig economy offers flexibility and opportunity, but it also attracts scammers looking to exploit those seeking independent work. Recognizing and avoiding gig economy scams is crucial to protecting your time, money, and personal information this year.

Understanding the Landscape of Gig Economy Scams

The gig economy, characterized by short-term contracts and freelance work, has seen explosive growth. However, this expansion has also attracted malicious actors. It’s essential to understand the types of scams prevalent in this space to protect yourself.

Common Types of Gig Economy Scams

Scammers often target gig workers with various tactics. Understanding these tactics is the first step in protecting yourself.

- Fake Job Postings: These listings promise high pay for minimal work, often requiring an upfront “investment” or personal information.

- Phishing Scams: Scammers impersonate legitimate companies or platforms to steal your login credentials and financial data.

- Payment Fraud: This includes delayed payments, bounced checks, or requests to send money back to the “employer” due to an overpayment.

By understanding these common scams, gig workers can be more vigilant and proactive in identifying and avoiding fraudulent opportunities.

Red Flags: Recognizing Scam Signals

Identifying red flags is crucial in avoiding gig economy scams. Many scams share similar characteristics that, once recognized, can alert you to potential danger. Knowing what to look for can save you time and resources.

What to Watch Out For

Keep an eye out for these common red flags to identify potential scams:

- Unrealistic Promises: Be wary of opportunities that promise excessively high pay for minimal effort or experience.

- Upfront Fees: Legitimate gig opportunities rarely require you to pay money upfront for training, materials, or background checks.

- Poor Communication: Grammatical errors, unprofessional emails, and vague job descriptions are often signs of a scam.

Being attentive to these red flags can help you discern genuine opportunities from scams. Always trust your gut feeling; if something seems too good to be true, it probably is.

Verifying Legitimacy: Steps to Check Offers

Before committing to any gig opportunity, it’s crucial to verify its legitimacy. Taking a few extra steps to check the offer can save you from potential scams.

Verifying the legitimacy of gig opportunities involves several steps. These checks can help ensure you are dealing with a genuine opportunity, not a scam.

- Research the Company: Look for the company’s website, check their social media presence, and read reviews on sites like Glassdoor or Indeed.

- Contact the Company Directly: Use the contact information listed on the company’s official website to verify the job posting.

- Use Scam Detection Tools: Utilize online scam detection tools or browser extensions to assess the legitimacy of the website or email.

By taking these verification steps, you significantly reduce the risk of falling victim to gig economy scams. Always prioritize caution and thorough investigation.

Protecting Your Information: Online Safety Practices

Protecting your personal and financial information is paramount in the gig economy. Scammers thrive on exploiting vulnerable data, so it’s crucial to adopt robust online safety practices.

Essential Online Safety Tips

Here are some tips to help you protect your data and avoid phishing schemes:

- Use Strong, Unique Passwords: Employ a password manager to generate and store complex passwords for all your online accounts.

- Enable Two-Factor Authentication: Add an extra layer of security to your accounts by enabling two-factor authentication whenever possible.

- Be Cautious with Personal Information: Avoid sharing sensitive personal or financial information via email or unsecured websites.

By following these practices, you significantly reduce the risk of your information falling into the wrong hands. Staying vigilant and proactive about your online security is essential.

Payment Security: Handling Financial Transactions

Understanding how to handle financial transactions securely is crucial in the gig economy. Scammers often use fraudulent payment methods to exploit unsuspecting workers.

When dealing with payments, be sure to stay alert and informed. Take proactive steps to protect your finances and avoid falling victim to payment-related scams.

Safe Payment Practices

Here are some tips for handling financial transactions securely:

- Use Secure Payment Platforms: Opt for reputable payment platforms like PayPal, Stripe, or direct bank transfers.

- Avoid Upfront Payments: As mentioned earlier, be wary of any job that requires you to pay money upfront.

- Keep Records: Keep detailed records of all payments received, payment dates, and contact information for each client or company.

By following these safe payment practices, you minimize the risk of financial fraud. Always prioritize secure and transparent payment methods.

Reporting Scams: Taking Action and Seeking Help

If you encounter a gig economy scam, it’s important to report it to the appropriate authorities and organizations. Your actions can help prevent others from becoming victims.

By taking action and reporting scams, you contribute to a safer gig economy for everyone. Your proactive involvement is essential in combating fraud.

Where to Report Scams

Report scams to these entities in your area:

- Federal Trade Commission (FTC): Report scams online at FTC.gov or call 1-877-FTC-HELP.

- Better Business Bureau (BBB): File a complaint with the BBB to alert others about fraudulent businesses.

- Local Law Enforcement: Report scams to your local police department, especially if you’ve suffered financial loss or identity theft.

By reporting scams, you not only protect yourself but also help create a safer environment for other gig workers. Your vigilance and willingness to take action are crucial.

| Key Point | Brief Description |

|---|---|

| ⚠️ Red Flags | Look for unrealistic promises, requests for upfront fees, and poor communication. |

| 🔍 Verification | Research companies, contact them directly, and use scam detection tools. |

| 🔒 Online Safety | Use strong passwords, enable two-factor authentication, and be cautious with personal data. |

| 💰 Payment Security | Use secure payment platforms and avoid upfront payments. |

Frequently Asked Questions

▼

A gig economy scam involves fraudulent job opportunities or schemes targeting freelance and contract workers, often promising high pay for minimal effort while aiming to steal money or personal information.

▼

Look for unrealistic promises, requests for upfront fees, poor grammar, vague job descriptions, and a lack of company information when assessing job postings.

▼

Stop all communication, gather evidence, and report the scam to the FTC, BBB, and local law enforcement to prevent further harm.

▼

Two-factor authentication adds an extra security layer by requiring a second verification method, like a code sent to your phone, making it harder for scammers to access your accounts.

▼

Secure payment platforms include PayPal, Stripe, and direct bank transfers, as they offer protection and encryption to prevent financial fraud during transactions.

Conclusion

Navigating the gig economy requires vigilance and awareness of potential scams. By recognizing red flags, verifying opportunities, protecting your personal information, and handling financial transactions securely, you can enjoy the benefits of flexible work while safeguarding yourself from fraud.