AI Fraud Detection: Can it Cut Fintech Losses by 15% in 6 Months?

AI-powered fraud detection offers a promising solution for fintech companies aiming to reduce losses, with potential impact depending on factors like algorithm accuracy, data quality, and implementation effectiveness, warranting careful evaluation and realistic expectations rather than a guaranteed 15% reduction within six months.

The fintech industry is constantly battling fraudulent activities, resulting in significant financial losses. Can **AI-powered fraud detection reduce fintech losses by 15% in the next 6 months**? Let’s explore the potential, challenges, and realistic expectations surrounding the adoption of AI in combating fraud within the fintech sector.

The Rising Tide of Fintech Fraud

The fintech industry’s rapid growth has been accompanied by a surge in sophisticated fraudulent activities. Understanding the nature and scale of these threats is crucial for evaluating the potential impact of AI-powered fraud detection systems.

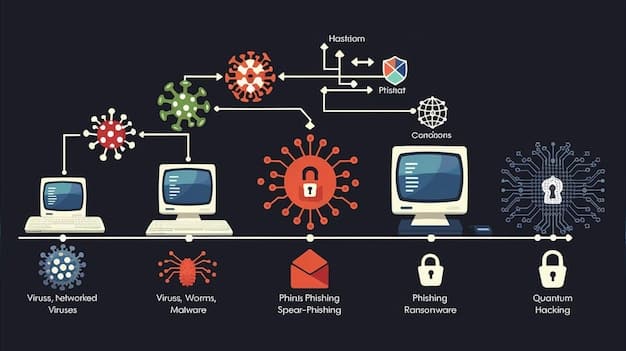

Types of Fintech Fraud

Fintech fraud takes various forms, each posing unique challenges. From identity theft to payment fraud, staying ahead requires constant vigilance.

- Identity Theft: Criminals using stolen or synthetic IDs to open accounts.

- Payment Fraud: Unauthorized transactions made using compromised financial information.

- Account Takeover: Gaining control of existing accounts to steal funds or data.

- Loan Application Fraud: Submitting false information to obtain loans.

These different facets of fraud need to be addressed comprehensively, using agile and robust technology such as AI.

The Financial Impact of Fraud on Fintech

Fraudulent activities have a severe impact on fintech companies, not only financially but also reputationally. These impacts affect everyone involved, from consumers to providers.

The direct financial losses from fraud can be substantial, impacting profitability and growth. Moreover, fintech companies must invest heavily in fraud prevention measures, adding to their operational costs. The reputational damage caused by fraud can erode customer trust, leading to customer churn and reduced business. This is why fraud management is one of the most important pillars of a successful fintech.

The increasing sophistication of fraud necessitates advanced solutions. With this in mind, let’s dive into how AI can provide a new level of safety for consumers and Fintechs alike.

Unveiling the Power of AI in Fraud Detection

AI is revolutionizing fraud detection by providing advanced analytical capabilities and real-time monitoring. Its ability to analyze vast amounts of data and identify patterns makes it an indispensable tool in the fight against financial crime.

How AI Algorithms Detect Fraud

AI algorithms employ various techniques to identify fraudulent activities. Machine learning models learn from historical data to recognize patterns indicative of fraud.

- Anomaly Detection: Identifying unusual transactions that deviate from normal behavior.

- Pattern Recognition: Recognizing known fraud patterns and flagging suspicious activities.

- Predictive Analytics: Forecasting potential fraud based on historical trends and data analysis.

These algorithms analyze transactional data, user behavior, and other relevant information to detect and prevent fraud.

Real-Time Monitoring and Analysis

AI-powered fraud detection systems offer real-time monitoring and analysis capabilities. They continuously scan transactions and user activities, identifying potential fraud as it occurs. This allows for immediate intervention, preventing further losses.

Traditional fraud detection methods often rely on manual review and rule-based systems, which can be slow and less effective against sophisticated fraud techniques. AI provides a dynamic and adaptive solution that can keep pace with evolving threats.

AI is an essential tool that can greatly enhance the security of transactions within the industry. Understanding its inner workings opens the door to smarter consumer practices and better fraud fighting techniques for Fintech providers.

Can AI Reduce Fintech Losses by 15% in 6 Months? A Realistic Assessment

While AI offers immense potential for fraud reduction, expecting a 15% reduction in losses within six months requires a realistic assessment of the factors involved.

Factors Influencing the Impact of AI

The effectiveness of AI-powered fraud detection depends on several factors. These include data quality, algorithm accuracy, and implementation strategy.

High-quality data is essential for training accurate AI models. Incomplete or biased data can lead to inaccurate predictions and missed fraud attempts. Secondly, the choice of AI algorithms and their configuration is vital. Different algorithms have varying strengths and weaknesses, and careful selection and tuning are necessary to optimize performance. Finally, a well-defined implementation strategy is crucial. This includes integrating the AI system with existing infrastructure, establishing clear fraud detection protocols, and providing training for personnel.

Potential Challenges and Limitations

Implementing AI-powered fraud detection systems comes with its own set of challenges and limitations. These must be addressed to maximize the effectiveness of the technology.

One challenge is the need for continuous model training and adaptation. Fraudsters are constantly developing new techniques, so AI models must be regularly updated to stay ahead of the curve. Another limitation is the potential for false positives. AI algorithms may sometimes flag legitimate transactions as fraudulent, leading to customer inconvenience and operational costs. Careful calibration and monitoring are necessary to minimize false positives.

Experiences and success cases

Let’s explore some case studies that show how AI has successfully been implemented to manage fraud and reduce losses in the fintech industry.

Success Stories of AI in Fintech Fraud Prevention

Several fintech companies have successfully implemented AI-powered fraud detection systems, achieving significant reductions in losses. These success stories provide valuable insights and lessons learned.

- Case Study 1: A digital payments company implemented an AI system that reduced fraudulent transactions by 20% within three months.

- Case Study 2: An online lending platform used AI to identify fraudulent loan applications, resulting in a 15% decrease in loan losses.

- Case Study 3: A neobank implemented real-time monitoring powered by AI, leading to the detection and prevention of numerous account takeover attempts.

These success stories highlight the potential of AI to transform fraud prevention in the fintech industry.

Overcoming Implementation Challenges

The journey to successful AI implementation is not without its challenges. Addressing these challenges proactively is essential for maximizing the benefits of the technology.

One common challenge is data integration. Fintech companies often have data spread across multiple systems, making it difficult to create a unified view for AI analysis. Data standardization and integration are necessary to overcome this challenge. Another challenge is algorithm selection. Choosing the right AI algorithms for specific fraud types requires careful evaluation and experimentation. A strategic partnership can greatly assist in avoiding some of the pitfalls that come with AI implementation in Fintech.

By learning from these experiences, fintech companies can navigate the complexities of AI implementation and achieve significant reductions in fraud losses thanks to an effective and efficient strategy.

The Future of AI in Fintech Fraud Detection

As AI technology continues to evolve, its role in fintech fraud detection will become even more prominent. Emerging trends and advancements promise to further enhance the capabilities of AI in combating financial crime.

Emerging Trends in AI Fraud Detection

Several emerging trends are shaping the future of AI in fraud detection. These include advancements in machine learning, the use of behavioral biometrics, and the integration of AI with blockchain technology.

Advances in machine learning are leading to more accurate and sophisticated fraud detection models. Behavioral biometrics uses AI to analyze user behavior patterns, such as typing speed and mouse movements, to identify fraudulent activities. Combining it with blockchain technology can provide a secure and transparent platform for fraud detection, enhancing trust and accountability.

Predictions for the Next 6 Months

Looking ahead to the next six months, we can expect to see further adoption of AI-powered fraud detection systems in the fintech industry. While a 15% reduction in losses may be ambitious for all companies, it is certainly achievable for some.

Companies that invest in robust data infrastructure, implement advanced AI algorithms, and foster a culture of continuous improvement will be best positioned to achieve significant reductions in fraud losses. As AI technology becomes more accessible and affordable, even smaller fintech companies will be able to leverage its power to protect their businesses and customers. Over time, it is likely that AI integration will be a standard among all companies.

Conclusion

AI-powered fraud detection offers a promising solution for reducing fintech losses, but achieving a 15% reduction within six months requires a nuanced understanding of the factors involved. While AI can significantly enhance fraud prevention, its effectiveness depends on data quality, algorithm accuracy, and implementation strategy. By addressing the challenges and limitations associated with AI adoption, fintech companies can leverage its power to protect their businesses and customers. As AI technology continues to evolve, its role in fintech fraud detection will become even more critical, paving the way for a safer and more secure financial ecosystem.

| Key Point | Brief Description |

|---|---|

| 🛡️ AI Fraud Detection | Uses algorithms to detect and prevent fraudulent activities in real-time. |

| 📈 Loss Reduction | Aims to reduce financial losses from fraud, but 15% in 6 months is a high bar. |

| 🔬 Data Quality | High-quality, unbiased data is crucial for accurate AI model training. |

| 🤖 Algorithm Selection | Choosing the right AI algorithms is essential for effective fraud detection. |

FAQ

▼

AI-powered fraud detection uses machine learning algorithms to analyze data and identify patterns that indicate fraudulent activity in real-time, offering faster and more accurate detection.

▼

While possible for some companies, it depends on factors like data quality, algorithm accuracy, and how well the system is integrated into existing processes. It isn’t a guaranteed outcome for all.

▼

Challenges include the need for high-quality data, continuous model training to adapt to new fraud tactics, and avoiding false positives that can disrupt legitimate transactions and potentially damage customer relationships.

▼

AI models are continuously updated with new data and patterns, allowing them to learn and adapt to the latest fraud techniques. Real-time analysis helps quickly identify and respond to new threats.

▼

Emerging trends include behavioral biometrics, which analyzes user behavior patterns, and integrating AI with blockchain for secure and transparent fraud detection, enhancing overall trust and security.

Conclusion

In conclusion, while AI presents a powerful tool for combating fraud in the fintech sector, achieving a specific reduction target like 15% within a short timeframe such as six months is highly dependent on various factors. Successful implementation requires careful planning, continuous optimization, and a realistic understanding of both the capabilities and limitations of AI technologies.