How Fintech in the US Uses Data Analytics for Personalized Customer Experiences

How Can US Fintech Companies Leverage Data Analytics to Personalize Customer Experiences? They can gain customer insights, offer tailored financial products, and elevate customer satisfaction by analyzing data to understand individual financial behaviors and preferences.

In today’s competitive landscape, **how can US fintech companies leverage data analytics to personalize customer experiences** is no longer a question, but a necessity. The ability to understand and cater to individual customer needs is what sets successful fintech companies apart. But how is this achieved in practice?

By strategically utilizing data analytics, fintech companies in the US can unlock valuable insights, offering tailored financial products, improving customer satisfaction, and gaining a significant competitive edge. Let’s delve into the specific strategies and benefits.

How Can US Fintech Companies Leverage Data Analytics to Personalize Customer Experiences?

To understand how can US fintech companies leverage data analytics to personalize customer experiences, one must first recognize the wealth of data available. Transactions, browsing history, app usage, and even social media activity can provide valuable clues about customer behavior and preferences. By effectively analyzing this data, fintech companies can create highly personalized experiences that resonate with their target audience.

This personalization can manifest in various ways, from offering customized financial advice and products to providing proactive customer support and fraud detection. The key is to use data insights to anticipate customer needs and deliver solutions that are both relevant and timely.

Understanding Customer Needs Through Data Analysis

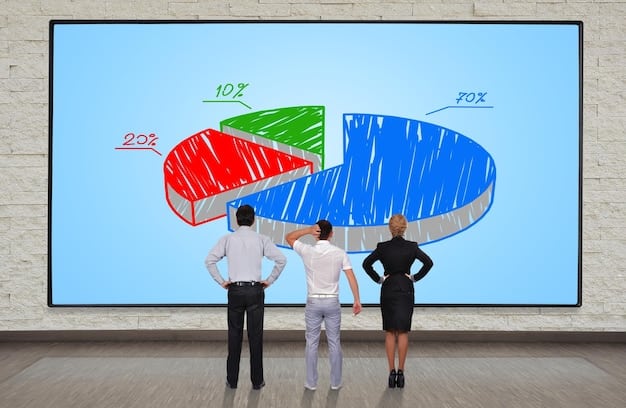

Data analytics allows fintech companies to move beyond generic offerings and truly understand the individual needs of their customers. By analyzing patterns in spending habits, investment choices, and financial goals, companies can create customer profiles that inform personalized interactions.

- Segmentation: Dividing customers into distinct groups based on shared characteristics allows for targeted marketing and product development.

- Behavioral Analysis: Understanding how customers interact with a fintech platform reveals valuable insights into their preferences and pain points.

- Predictive Modeling: Using historical data to forecast future customer behavior enables proactive intervention and personalized recommendations.

Ultimately, leveraging data analytics to understand customer needs is about building stronger, more meaningful relationships. When customers feel understood and valued, they are more likely to remain loyal and recommend a fintech company to others.

Tailoring Financial Products with Data Insights

Beyond simply understanding customer needs, how can US fintech companies leverage data analytics to personalize customer experiences through tailored financial products? The answer lies in using data insights to design products that are specifically suited to individual customer profiles and goals. This level of personalization can significantly increase product adoption and customer satisfaction.

For example, a fintech company analyzing a customer’s spending habits might identify an opportunity to offer a high-yield savings account that automatically transfers excess funds. Alternatively, a company might use investment data to create a personalized portfolio that aligns with a customer’s risk tolerance and financial objectives.

Examples of Personalized Financial Products

The possibilities for personalized financial products are virtually endless. Here are a few examples of how data analytics can be used to create tailored offerings:

- Personalized Loan Rates: Offering loan rates based on individual creditworthiness and risk profiles.

- Customized Investment Portfolios: Creating investment portfolios that align with individual financial goals and risk tolerance.

- Tailored Insurance Products: Designing insurance policies that meet the specific needs of individual customers.

By leveraging data analytics to create personalized financial products, US fintech companies can stand out from the competition and attract customers who are seeking truly tailored solutions.

Enhancing Customer Service Through Data-Driven Personalization

Customer service is a critical touchpoint for any business, and how can US fintech companies leverage data analytics to personalize customer experiences in this area is paramount. By using data to understand customer needs and preferences, fintech companies can provide more efficient and effective support, leading to increased customer satisfaction and loyalty.

For example, a customer calling a support line can be automatically routed to an agent who is familiar with their account history and previous interactions. This eliminates the need for the customer to repeat information and allows the agent to quickly address their needs.

Proactive Customer Support

Data analytics can also be used to provide proactive customer support. By identifying potential issues before they arise, fintech companies can intervene and offer assistance, preventing frustration and building goodwill. Data-driven personalization provides a superior customer service experience

Imagine a scenario where a fintech company detects unusual spending activity on a customer’s account. The company might proactively reach out to the customer to verify the transactions and offer assistance in securing their account. This type of proactive service demonstrates a commitment to customer security and builds trust.

Ultimately, a data-driven approach to customer service is about anticipating customer needs and providing solutions that are both timely and relevant. This results in increased customer satisfaction, loyalty, and advocacy.

Improving Fraud Detection and Security with Data Analytics

In the digital age, fraud and security are major concerns for both fintech companies and their customers. So, how can US fintech companies leverage data analytics to personalize customer experiences by beefing up fraud detection? By analyzing transaction patterns and user behavior, fintech companies can identify and prevent fraudulent activity more effectively.

For instance, if a customer typically makes small transactions within a specific geographic area, a sudden large transaction from a foreign country might trigger a fraud alert. This allows the company to quickly investigate the transaction and protect the customer’s account.

Real-Time Fraud Monitoring

In addition to detecting fraudulent transactions, data analytics can also be used to monitor user behavior in real-time. By tracking login attempts, password changes, and other account activity, fintech companies can identify suspicious patterns and take proactive steps to prevent account takeover.

This level of vigilance is essential for maintaining customer trust and protecting sensitive financial information. When customers feel confident that their accounts are secure, they are more likely to use a fintech platform and recommend it to others.

The Future of Personalized Fintech Experiences

As technology continues to evolve, the potential for personalized fintech experiences will only continue to grow. How can US fintech companies leverage data analytics to personalize customer experiences going forward? With advances in artificial intelligence and machine learning, fintech companies will be able to analyze even more data and create even more sophisticated personalized offerings.

In the future, we can expect to see fintech platforms that anticipate our financial needs before we even realize them, offering customized advice and products that seamlessly integrate into our daily lives. This level of personalization will transform the way we interact with financial services and create a more seamless and intuitive experience.

To stay ahead of the curve, US fintech companies must invest in data analytics capabilities and develop a customer-centric approach to product development and service delivery. By embracing the power of data, they can create personalized experiences that resonate deeply with their customers and drive long-term growth.

Risks and Considerations When Leveraging Data Analytics

While the benefits of leveraging data analytics are clear, US Fintech companies must also be cognizant of potential risks and challenges. So, with all of these advancements and insights to be gained, how can US fintech companies leverage data analytics to personalize customer experiences while managing risks? Data privacy concerns are paramount. Customers are increasingly sensitive about how their data is collected and used, and companies must be transparent and responsible in their data handling practices.

Furthermore, companies need to be wary of algorithmic bias, which can lead to discriminatory outcomes. It’s crucial to ensure that algorithms are fair and unbiased and that they don’t perpetuate existing inequalities.

Data Security and Compliance

Data security is another critical consideration. Fintech companies must implement robust security measures to protect customer data from breaches and cyberattacks. Compliance with data privacy regulations, such as GDPR and CCPA, is also essential.

By addressing these risks and challenges proactively, US fintech companies can build trust with their customers and create a sustainable foundation for data-driven personalization.

| Key Point | Brief Description |

|---|---|

| 📊 Data-Driven Insights | Analyzing data helps understand customer behavior. |

| ✨ Personalized Products | Tailoring financial products to individual needs. |

| 🛡️ Fraud Detection | Using data to prevent fraudulent activities. |

| 🤝 Enhanced Support | Improving customer service through data insights. |

Frequently Asked Questions

Data analytics identifies patterns leading to churn, enabling targeted interventions. Personalized communications, tailored offers, and proactive support enhance customer satisfaction and loyalty, reducing attrition.

Transaction history, browsing behavior, demographic data, and app usage patterns are highly valuable. Combining these data points provides a comprehensive view of customer preferences, enabling effective personalization strategies.

Implement robust data governance policies, anonymize data where possible, and obtain explicit consent for data usage. Transparency and adherence to privacy regulations are crucial for building customer trust.

Data silos, lack of skilled data scientists, and integration with legacy systems are common challenges. A well-defined data strategy and investment in talent and technology are essential for success.

Yes, AI algorithms can analyze vast datasets to identify patterns and predict customer behavior more accurately. This enables hyper-personalization, automated recommendations, and real-time decision-making, improving overall customer satisfaction.

Conclusion

In conclusion, how can US fintech companies leverage data analytics to personalize customer experiences boils down to adopting a data-driven culture, investing in the right technologies, and prioritizing customer privacy. By embracing these principles, fintech companies can unlock the full potential of data analytics and create personalized experiences that drive growth and build lasting customer relationships.

The future of fintech is undoubtedly personalized, and those companies that embrace data analytics will be best positioned to thrive in this evolving landscape.